Contents:

Semi-monthly paychecks are paid on the 1st and 15th of the month or the 15th and 30th. Employees receive 24 paychecks per year.Biweekly paychecks are paid every two weeks, usually on Friday. Adjust for sick time, vacation, and/or leaves of absence. If you are paid for vacation or sick leave, then you do not need to adjust any of your calculations.

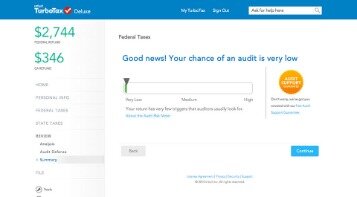

- One way to manage your tax bill is by adjusting your withholdings.

- It is calculated by subtracting sales from the cost of goods sold .

- Examples of payment frequencies include biweekly, semi-monthly, or monthly payments.

- Workers with at least bachelor’s degrees earned $81,432 annually on average.

If a t account refers to its annual sales revenue as being $20 million, they might also say that its gross income is $20 million. Employees who receive a salary are paid the same amount periodically, regardless of how many hours or days they work over the time period. Employees who earn a wage are paid based on a rate that is multiplied by the number of hours or days they worked during a period. Annual income is the total value of income earned during a fiscal year. Gross annual income refers to all earnings before any deductions are made, and net annual income refers to the amount that remains after all deductions are made. The concept applies to both individuals and businesses in preparing annual tax returns.

Of course, if you opt for more withholding and a bigger refund, you’re effectively giving the government a loan of the extra money that’s withheld from each paycheck. You could also use that extra money to make extra payments on loans or other debt. Federal and local governments grant numerous tax breaks for businesses. Things like having an energy-efficient building, providing benefits for employees, and using renewable energy sources may qualify you for a tax break.

– 2023 Federal Standard Deductions

The FICA rate due every pay period is 15.3% of an employee’s wages. However, this tax payment is divided in half between the employer and the employee. You will need to know your annual income if you are paying alimony or child support, too. Of course, knowing your annual income can help you file your taxes and tax return documents. If you’re still unclear about how much taxes you need to pay, it may be a good idea to get a free tax consultation.

The following are only generalizations and are not true for everyone, especially in regards to race, ethnicity, and gender. The most common pay period frequencies tend to be monthly, semi-monthly , bi-weekly , weekly, and daily. After taxes, benefits, and deductions are withheld, the remaining amount is called your net pay.

Total Estimated 2022 Tax Burden

The IRS mandates employers to send 1099 forms to workers who are paid more than $600 during a tax year. Gross income is the combination of all income including salary, investments, and interest on savings. Using any of these platforms helps take the work out of calculating your net worth, which makes it more likely that you’ll actually track your progress each month. And tracking your progress matters, because it keeps building wealth front-of-mind and tangible, which helps keep you on course for your long-term financial goals. Speaking of budgeting, Mint helps you form a monthly budget and alerts you when you veer from it. They also display a graph of your net worth progress over time to help you visualize it.

Does Your Income Affect Your Credit Score? Chase – Chase News & Stories

Does Your Income Affect Your Credit Score? Chase.

Posted: Sat, 08 Oct 2022 07:41:16 GMT [source]

The annual income calculator’s main aim is to help you find your yearly salary. However, it can calculate the rest of the variables – it depends on which values you input first. There can be other ways to earn money including capital gains, dividends, and royalties. They are also not considered earned income, so they may be taxed differently from earned income sources.

How to Calculate Net Income

For credit scores above 580 and if other compensating factors are met, the DTI ratio may be as high as 40/50 for manually underwritten FHA loans. The lower your DTI ratio, the more likely you will be able to afford a mortgage — opening up more loan options. A DTI of 20% or below is considered excellent, while a DTI of 36% or less is considered ideal. Compare your debt-to-income ratio to our measurement standards below.

We’ll cover how to calculate it, as well as the different types of annual income. This article was co-authored by Hannah Cole and by wikiHow staff writer, Finn Kobler. Hannah Cole is an Enrolled Agent and the Founder of Sunlight Tax. She has her Enrolled Agents license, which is a tax expertise and representation credential issued by the IRS. Hannah received her BA in Art History from Yale University, MFA in Painting from Boston University, and studied accounting at Brooklyn College.

And don’t forget to look at the top of my website for the “Calculator” tab to see more fun interactive personal financial calculators to use, for free. Lastly, sign up below for our free newsletter so that you don’t miss any of our future calculators as well. No matter what method you use to try to increase your income, it is important to remember that it takes time and effort to see results. However, if you are patient and persistent, you can eventually achieve your financial goals.

Examples of Calculating Annual Income

Some other developed countries around the world have vacation time of up to four to six weeks a year, or even more. Generally, only employees who work in a branch of the federal government benefit from all federal holidays. Employees that work for private employers are subject to the policy of their employer. However, states may have their own minimum wage rates that override the federal rate, as long as it is higher. For instance, the District of Columbia has the highest rate of all states at $16.50 and will use that figure for wage-earners in that jurisdiction instead of the federal rate.

Income is not limited to just salary, which can vary depending on the sources of the monetary funds you receive. This includes passive income fromrental, interest, and dividends, or profits from a business or business deal that may come as bonuses and commissions. Performance Reviews—Most employers give out annual performance reviews to their employees. Annual reviews that are, for the most part, positive are generally followed by an annual pay raise. If no raise is given, even after a glowing review, it may be in the employee’s best interest to ask for a salary increase or begin considering other employment options.

For manually underwritten VA loans, on the other hand, the total maximum DTI is typically 41%. The maximum debt-to-income ratio for FHA loans is 55% when using an Automated Underwriting System but may be higher in some cases. Manually underwritten FHA loans allow for a front-end maximum of 31% and back-end maximum of 43%.

However, if you do not get paid for these absences, subtract the number of weeks you were absent from 52 to calculate your annual salary. Once you have subtracted deductions from your adjusted gross income, you have your taxable income. If your taxable income is zero, that means you do not owe any income tax.

What to Include in Your Annual Net Income

Therefore, annual income means the amount of money obtained during a year. Like wages, the number of hours worked also depends on your industry. Employees in mining and logging work for an average of 46.3 hours a week, while those in leisure and hospitality work for an average of 25.3 hours a week. By having two weeks unpaid, their annual income would be $30,000, which is $1,200 less compared to the previous example. If the employee had negotiated to have these two weeks as paid time off, their annual income would be $31,200 instead. It is also important to note that some of these earnings may be taxed separately from your income.

You face specific challenges that require solutions based on experience. Small, midsized or large, your business has unique needs, from technology to support and everything in between. See how we help organizations like yours with a wider range of payroll and HR options than any other provider.

Previously, Jean was a real estate broker, an English teacher, and a trip leader for an adventure travel company. She is co-founder of PowerZone Trading, a company that has provided programming, consulting, and strategy development services to active traders and investors since 2004. Multiply the result by the number of weeks you work per year. Stay on top of your finances in under 5 minutes per week.

Prevalence and factors associated with underweight among 15–49 … – bmcwomenshealth.biomedcentral.com

Prevalence and factors associated with underweight among 15–49 ….

Posted: Sat, 22 Apr 2023 03:50:24 GMT [source]

Proof of knowledge can come in many other different forms. For one, qualifications or certifications are a less time-consuming and financially significant undertaking that can still result in a salary increase. Simply increasing relevant knowledge or expertise that pertains to a niche profession or industry can increase salary. This may involve staying up-to-date on current events within the niche by attending relevant conferences or spending leisure time reading on the subject. Most employers (over 75%) tend to provide vacation days or PTO for many beneficial reasons. As an aside, European countries mandate that employers offer at least 20 days a year of vacation, while some European Union countries go as far as 25 or 30 days.

A paycheck is a directive to a financial institution that approves the transfer of funds from the employer to the employee. A pay stub, on the other hand, has no monetary value and is simply an explanatory document. Gender—Men earned an average salary of $60,528, and women earned $50,492. Women are generally paid less than men, and this difference is called the gender pay gap.

There is a minimum wage set by the US Federal government. Some states choose to set their own minimum wage as long as it is higher than the minimum set by the Federal government. The US federal minimum wage was set at $7.25 per hour on July 27, 2009. Even though the federal minimum wage has not been updated in a while, many states update their minimum wages much more often. Annual income refers to the amount of money earned in one year, which may be helpful for budgeting since some earnings and expenses may not be consistent throughout the year. The most common type of income is earned income, which is money that is earned through working.